Home

Business finances and solvency can be complicated topics; you may even find yourself faced with an unusual set of circumstances.

Gerry Rea Partners is a chartered accountancy practice that’s here to help guide you through difficult times. We have highly experienced qualified accountants and licenced insolvency practitioners who can assist you in solving complicated issues.

We will listen to you to gain a better understanding of the issues associated with your company, business or personal circumstances to determine how we may best be of service. All solutions — no matter how complex — start with the same thing: communication.

We specialise in the following areas:

- Business restructuring advice and services

- Insolvency advice and services

- Share and business valuation services

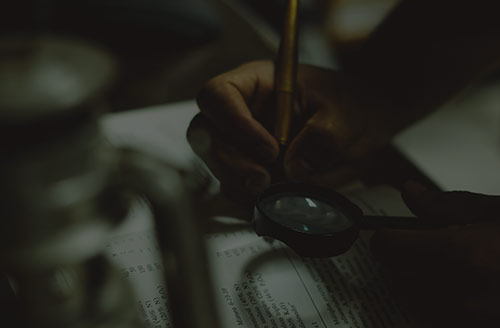

- Forensic accounting and fraud detection

- Relationship property issues

- Litigation support services

Gerry Rea Partners was formed in 1998 through the linking up of three senior accounting practitioners to establish what has become a well known and respected Auckland-based practice. We are an independent firm, offering effective solutions.

Our services are available to:

- Individuals

- Shareholders or owners

- Directors

- Creditors and

- Financiers of companies

Where support and advice may be required to manage change, encourage development or address solvency issues, Gerry Rea Partners will lead the way.

Meet the team

Book a FREE consultation

We offer a free consultation to talk through your company’s financial issues so that we can seek the appropriate solution to your problems together.

Subscribe to our newsletter

Associations